DOGE Price Prediction: ETF Catalyst Could Drive 860% Surge According to Technical and Fundamental Analysis

#DOGE

- Technical indicators show DOGE trading above key moving average with bullish momentum

- 91% probability of ETF approval creating massive fundamental catalyst

- Expert predictions suggest potential 860% price surge upon successful ETF launch

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Average

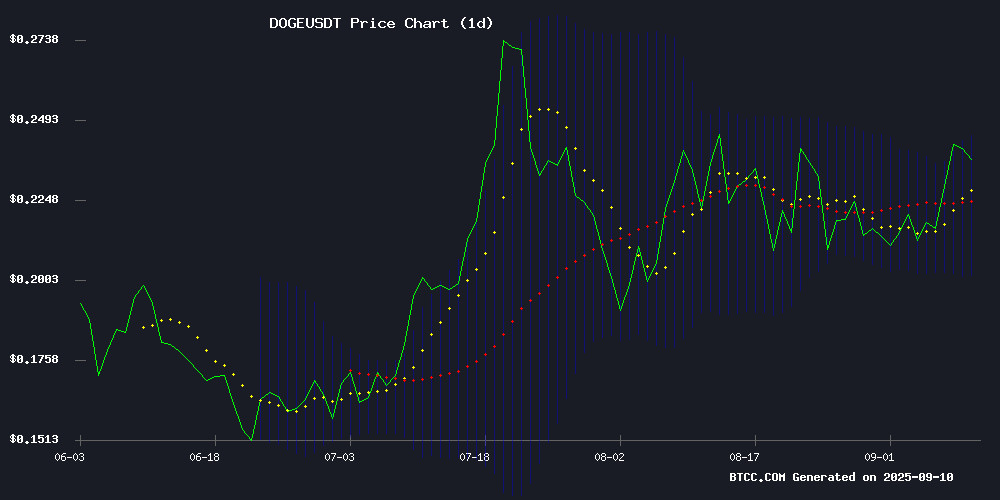

According to BTCC financial analyst Emma, DOGE is currently trading at $0.2403, comfortably above its 20-day moving average of $0.2234, indicating sustained bullish momentum. The MACD reading of -0.000853 suggests some near-term consolidation, but the price position NEAR the upper Bollinger Band at $0.2453 signals potential breakout conditions. Emma notes that maintaining above the middle band at $0.2234 could pave the way for further upward movement toward resistance levels.

Market Sentiment: Extreme Bullishness on ETF Approval Prospects

BTCC financial analyst Emma observes that market sentiment is overwhelmingly bullish due to the 91% probability of Dogecoin ETF approval, with multiple experts predicting imminent launch. The anticipation of regulatory approval has created substantial buying pressure, though Emma cautions that traders should prepare for potential volatility around the actual announcement. The combination of technical breakout patterns and fundamental ETF catalysts creates a powerful bullish setup for DOGE.

Factors Influencing DOGE's Price

Dogecoin ETF Approval Odds Hit 91% as Traders Anticipate Volatility

Dogecoin is poised for a Wall Street debut as the REX-Osprey Doge ETF ($DOJE) nears launch, with Polymarket traders pricing in a 91% approval probability by year-end. The non-traditional SEC registration bypass has heightened speculation about imminent price action.

Analysts warn of potential liquidations and bot-driven volatility. Alphractal CEO Joao Wedson cautioned against short positions, noting high-frequency trading algorithms could exacerbate swings. Nate Geraci predicts a "wild" period for crypto ETFs as institutional interest grows.

The memecoin's potential ETF listing marks a watershed moment for altcoin adoption, though the unconventional regulatory path introduces uncertainty. Market makers appear positioned for significant order FLOW around the launch window.

Dogecoin Poised for Breakout Amid ETF Speculation and Technical Patterns

Dogecoin's price trajectory is drawing heightened attention as analysts flag a potential breakout this week. The meme coin, after weeks of sideways movement, faces a pivotal moment with two converging catalysts: speculative ETF approval and a bullish technical formation.

Market observers point to rumors of a U.S.-listed Dogecoin ETF launching imminently—a development that would mirror the institutional validation seen with Bitcoin and ethereum funds. Historical precedent suggests such approvals trigger substantial price appreciation across crypto assets.

Technical charts reveal a falling wedge pattern on Dogecoin's 4-hour timeframe, traditionally a harbinger of bullish reversals. The asset appears to be completing an accumulation phase NEAR key support levels, with volatility compression typically preceding directional moves.

First US Dogecoin ETF Could Launch Thursday Amid Market Hesitation

Dogecoin's potential ETF debut this week has sparked cautious Optimism in crypto markets. Eric Balchunas, a senior ETF analyst, signaled a Thursday launch for the $DOJE fund under the 40 Act framework—potentially marking the first US-listed product tracking an asset with intentionally zero utility.

The meme coin rallied briefly on the news before paring gains, reflecting trader skepticism after the SEC's history of cold feet on altcoin ETFs. Approval WOULD represent a watershed moment for both DOGE and the broader crypto sector, opening regulatory pathways for other speculative assets.

Market observers note the irony of a Shiba Inu-themed cryptocurrency potentially achieving institutional recognition before more 'serious' blockchain projects. The SEC's decision could recalibrate market expectations around what constitutes an acceptable underlying asset for regulated products.

Dogecoin Rallies on ETF Approval Speculation

Dogecoin (DOGE) surged 1.64% in Tuesday's trading, extending its 13.9% weekly gain as the meme token leads top-10 cryptocurrencies by market cap. The rally follows growing anticipation of SEC approval for a Dogecoin ETF, which would mark the first such fund for a meme-based digital asset.

Bloomberg reports Rex Shares and Osprey Funds have collaborated on a dogecoin ETF filing under the Investment Company Act of 1940 framework. Market observers suggest approval could come as early as Thursday, potentially creating new institutional demand for the cryptocurrency.

The proposed ETF represents a strategic shift from previous crypto fund applications, which typically relied on the Securities Act of 1933. This regulatory arbitrage could set a precedent for other speculative tokens seeking mainstream financial product status.

Market Expert Says Dogecoin ETF Will Launch Within Days, Predicts 860% Price Surge

The REX-Osprey DOGE ETF, trading under ticker $DOJE, is poised to become the first regulated investment vehicle offering direct Dogecoin exposure. Market analyst Javon Marks projects a $2.28 price target for Dogecoin, implying potential gains exceeding 860% from current levels.

REX Shares has confirmed development of the ETF through official announcements, with a complete prospectus filed with the SEC. The fund will provide traditional investors regulated access to Dogecoin's price movements without direct cryptocurrency ownership.

Industry observers suggest the ETF could begin trading before week's end, signaling accelerated institutional adoption of meme coins. The filing's advanced stage lends credibility to near-term launch predictions.

Is DOGE a good investment?

Based on current technical indicators and fundamental developments, DOGE presents a compelling investment opportunity according to BTCC financial analyst Emma. The convergence of strong technical positioning above key moving averages and the overwhelming 91% probability of ETF approval creates a favorable risk-reward scenario. However, investors should be aware of potential volatility around the ETF decision and consider position sizing accordingly.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $0.2403 | Above 20-day MA, bullish |

| 20-day Moving Average | $0.2234 | Support level |

| Bollinger Upper Band | $0.2453 | Near-term resistance |

| ETF Approval Probability | 91% | Extremely bullish catalyst |

| Projected Price Surge | Up to 860% | If ETF approved |